Professional Collaborations and Models

PART III: Case Study: Converting a $1M Mixed Portfolio to CEFs

This series of slides shows account content during the transition process of a $1,000,000 portfolio of most mutual funds, a few ETFs, and a few common stocks to a mostly CEF portfolio. You will see impressive growth in working capital and realized income over a very short period of time.

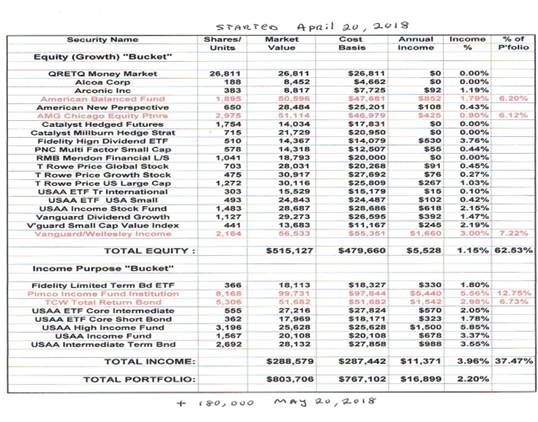

Step 1: Analyze the Existing Portfolio

Below is the breakdown of the mutual funds, stocks, and ETFs in this investor's portfolio at the start of the process on April 20, 2018. The positions that exceed 5% of total working capital are noted in red.

The portfolio was 60% equity or growth focused vs. 40% income focused when received. I had free rein in determining what was sold immediately and progressively until the transition was completed.

Note that the average portfolio yield was just 2.20% and that the number of shares of all positions is not a round number. This indicates that all distributions from the securities were automatically reinvested. This fact, and the age of the owner of the account, means that every penny of the annual 4% withdrawals (RMDs for sure) had to be dealt with by selling securities or transferring them to other accounts.

The objective of the transition was to have all withdrawals come from income produced by the portfolio while reinvesting any excess.

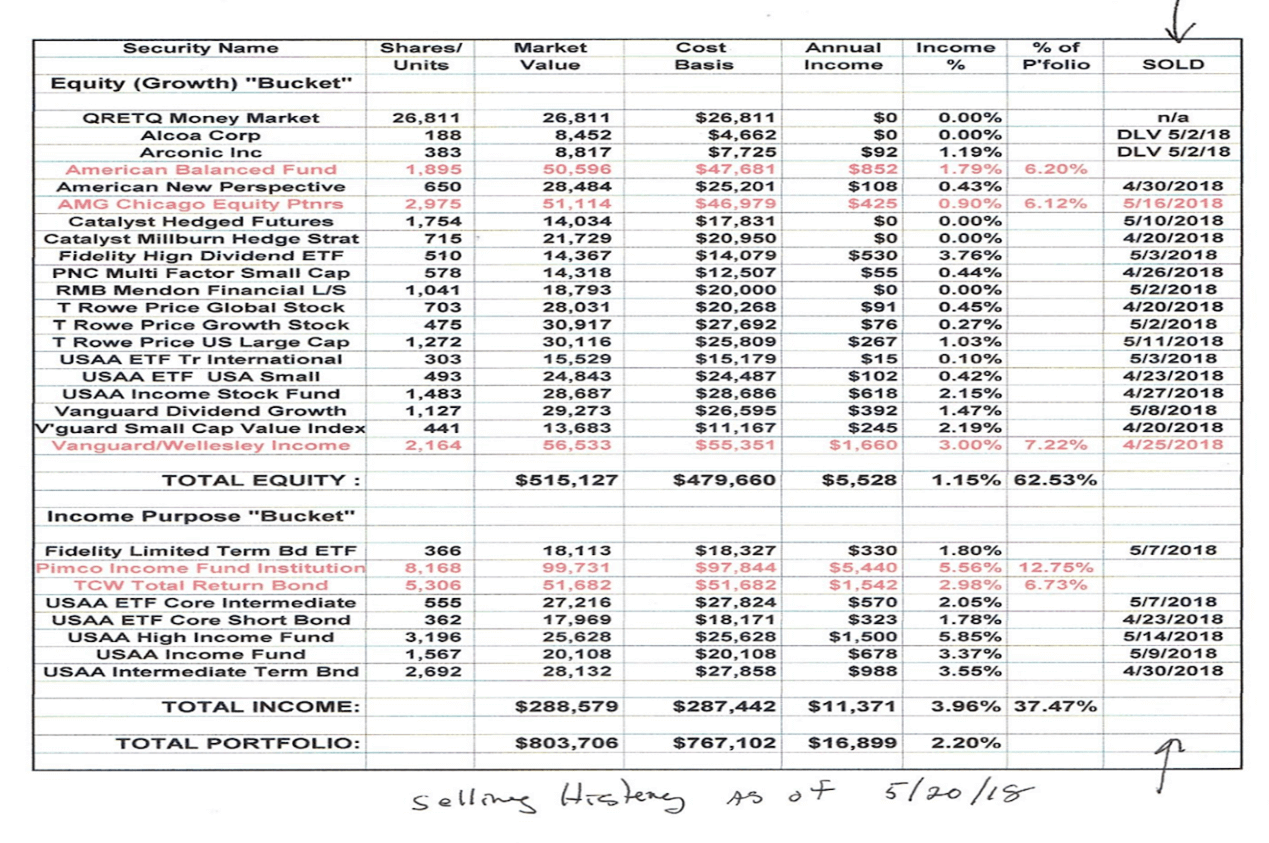

May 2018: Selling History

In this statement, you can see that I had sold most of the funds within thirty days. The two stocks were transferred to a separate account. All the proceeds were invested in Closed End Funds and a few undervalued common stocks.

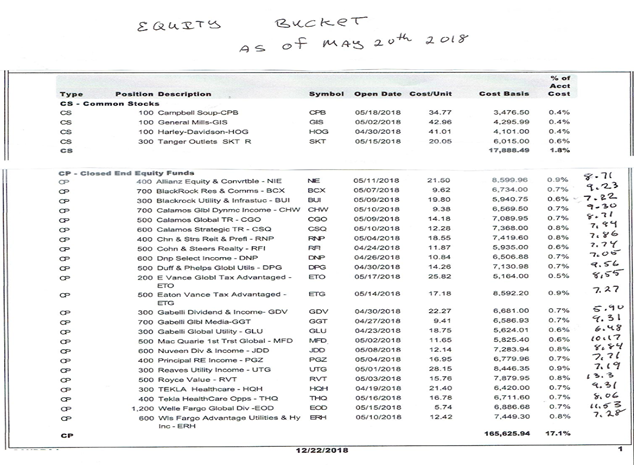

Transitioning to CEFs

By late May, I'd transitioned all but one of the original equity funds into equity CEFs and Income CEFs. The next portfolio snapshot shows the equity "bucket" content one month into the transition. Most of these CEFs were still in my equity universe in 2023. In the far-right margin, I've indicated their distribution yields. The smallest yield is 6.90%. More than 50% of the funds were paid over 8%.

Note that no holding is over 1% of total working capital at this point.

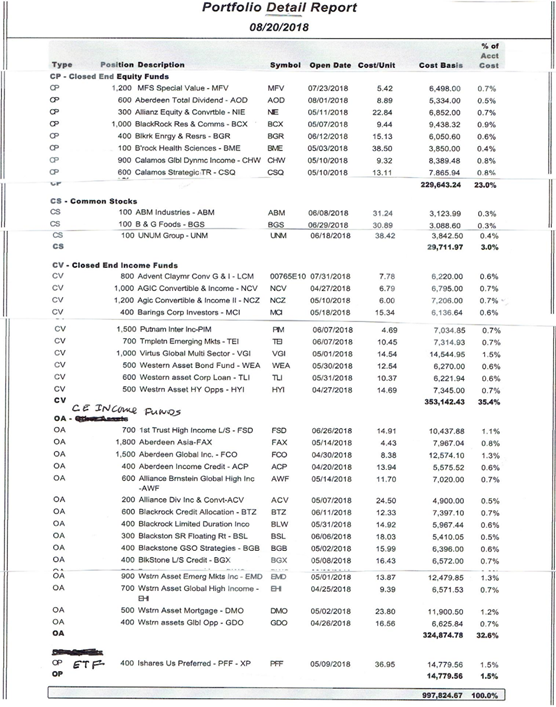

A Partial View of the August Portfolio

Early in June, an additional $180,000 in cash was deposited into the account by the investor–which accounts for the much larger total working capital in the next slide. At this point, the portfolio is almost all CEFs, and almost fully invested, and the slide does not show nearly all of the securities inside.

Note the Size of the Income CEF Bucket

In this partial portfolio snapshot from August 2018, note that the two biggest holdings don't exceed even 2 percent of total working capital. There are roughly 75 income CEF positions, several new common stock positions, and one preferred stock content ETF.

Results: Year-End 2018

By the end of 2018, the portfolio is 70% income focused, the reverse of the initial mix. Here are the basics:

Here's another update 6 months later, in June 2019. Note that the individual portfolio, the one into which the original stocks were transferred, has become a depository for all the main account RMD payments, about $3,000 monthly. It had grown to about $50,000.

Need more help?

Already read Retirement Money Secrets? It should be available on Amazon by August 2023. Otherwise, check out the rest of my website for a range of free resources, plus information on how to join my private educational Facebook Group or connect with me for income investment coaching.